Solutions

Products

-

Primary mobile crushing plant

-

Independent operating combined mobile crushing station

-

Mobile secondary crushing plant

-

Fine crushing and screening mobile station

-

Fine crushing & washing mobile station

-

Three combinations mobile crushing plant

-

Four combinations mobile crushing plant

-

HGT gyratory crusher

-

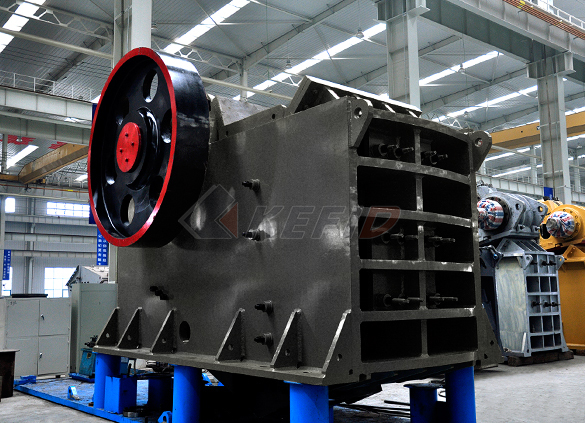

C6X series jaw crusher

-

JC series jaw crusher

-

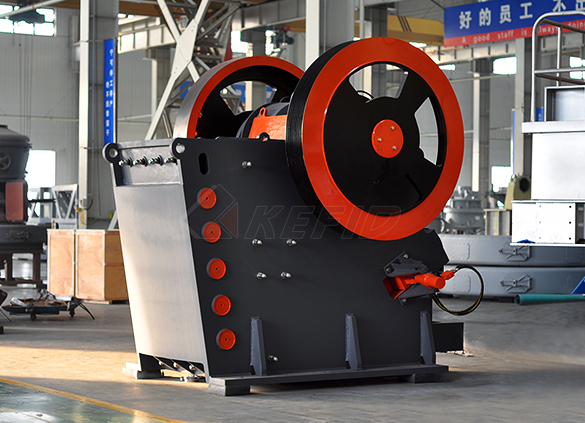

Jaw crusher

-

HJ series jaw crusher

-

CI5X series impact crusher

-

Primary impact crusher

-

Secondary impact crusher

-

Impact crusher

-

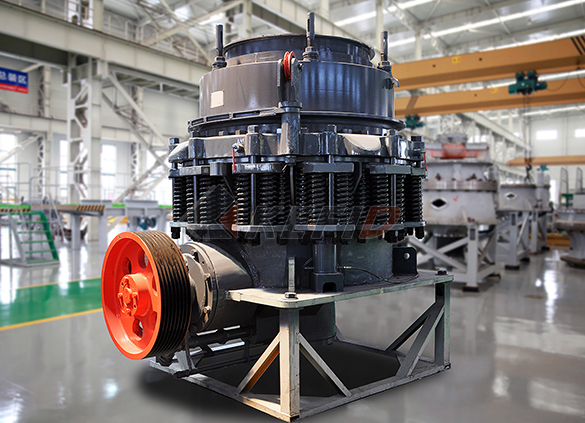

HPT series hydraulic cone crusher

-

HST hydraulic cone crusher

-

CS cone crusher

-

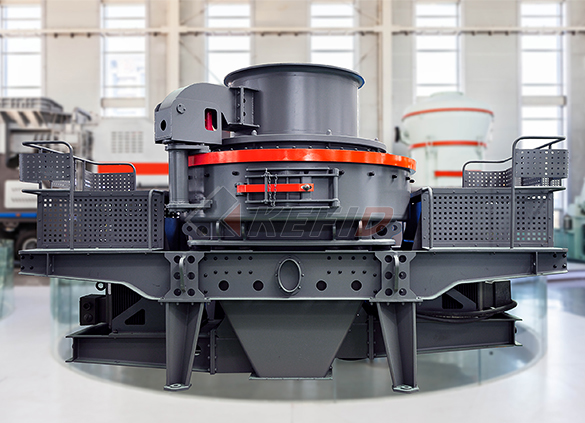

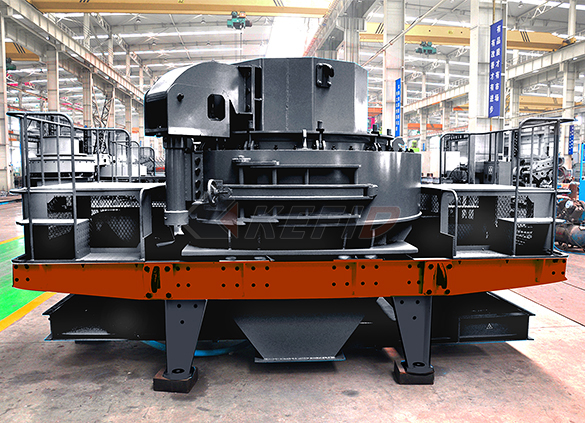

VSI6S vertical shaft impact crusher

-

Deep rotor vsi crusher

-

B series vsi crusher

-

Vertical grinding mill

-

Ultra fine vertical grinding mill

-

MTW european grinding mill

-

MB5X158 pendulum suspension grinding mill

-

Trapezium mill

-

T130X super-fine grinding mill

-

Micro powder mill

-

European hammer mill

-

Raymond mill

-

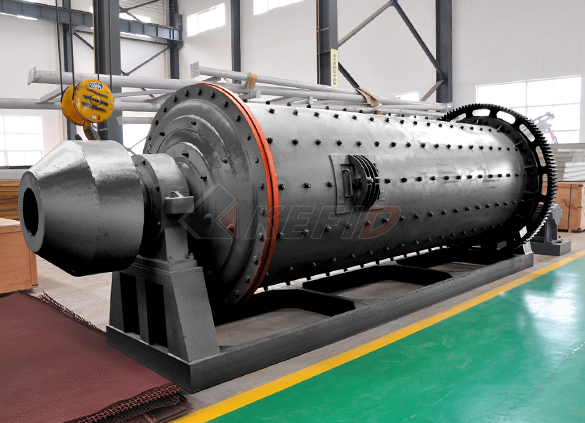

Ball mill

-

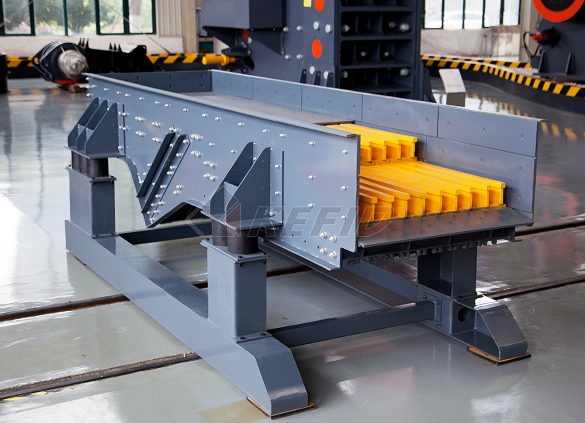

GF series feeder

-

FH heavy vibrating feeder

-

TSW series vibrating feeder

-

Vibrating feeder

-

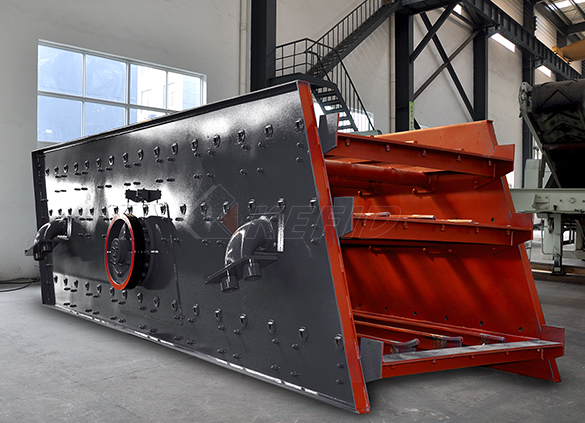

Vibrating screen

-

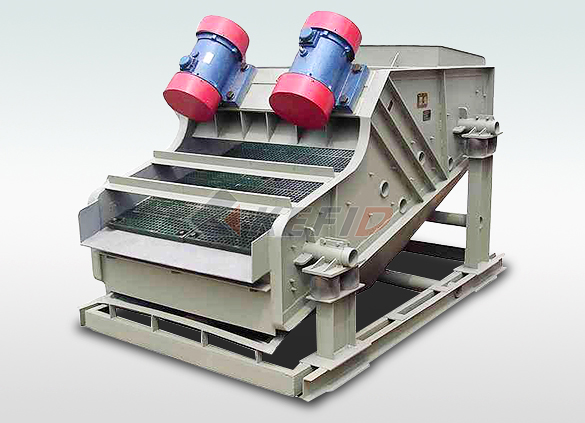

S5X vibrating screen

-

Belt conveyor

-

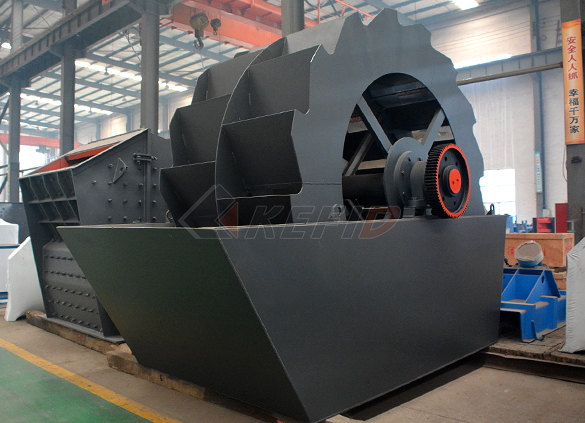

Wheel sand washing machine

-

Screw sand washing machine

-

Rod mill

-

Dryer

-

Rotary kiln

-

Wet magnetic separator

-

High gradient magnetic separator

-

Dry magnetic separator

-

Flotation machine

-

Electromagnetic vibrating feeder

-

High frequency screen

Mining Law 2021 Laws and Regulations Zimbabwe ICLG

Zimbabwe: Mining Laws and Regulations 2021 ICLG Mining Laws and Regulations Zimbabwe covers common issues in mining laws and regulations – including the acquisition of rights, ownership requirements and restrictions, processing, transfer and encumbrance, environmental aspects, native title and land rights – in 15 jurisdictionsIncome of a holder of special mining lease 14(2)(f) 15% Income of a company or trust derived from mining operations Rate is based on tax chargeable : 3% Dividends from company incorporated outside Zimbabwe 14(5) 20% Income of Special Economic Zones for the First 5 years of operationTax Rates Zimbabwe Revenue AuthorityTaxation For The Mining Industry by Tamuka Maziriri is an easy guide for miners in Zimbabwe and it contains an updated information and [] See book Buy Paperback por $ 2052Taxation in Zimbabwe Tamuka Maziriri BubokDec 18, 2020 Victor Bhorom :analyst Zimbabwe’s 2021 national budget paints a picture of sustained austerity in the midterm, with increases in taxes for various sectors of the depressed economy A 126% jump in budgeted tax revenue collections from the ZW$173 billion anticipated in 2020 to ZW$391,8 billion (US$4,8 billion) budgeted for 2021 says it all More importantly []Economic growth stimulus should precede taxation The employment tax rates Deductibility of mining royalties effective 01/01/20 Amendments of specified amounts invarious tax provisions Changes to rate of Capital Gains Tax and Capital Gains Withholding Tax A supplementary budget was presented, which proposed to increase government spending by 140%, from ZW$77 billion to ZW$186 billionZimbabewe 2019 midterm fiscal policy review

Zimbabwe government mulls new mining taxation The Insider

Zimbabwe government mulls new mining taxation by The Insider 5 years ago 5 years ago 0 The government has approved the drafting of a new tax regime in mining sector it hopes will help bring investment into the cashstarved sector and plans to overhaul the country’s income tax laws as well, Finance Minister Patrick Chinamasa said today Mar 14, 2018 Taxation is a significant issue for Zimbabwe’s mining sector to tackle, and the country would be wise to look to other mining authorities as a gauge of how best to retain a competitive edge Attention was also drawn to the outdated principle mining law that was first introduced in 1960Law in Zimbabwe still needs reform to attract mining Jan 05, 2015 this is a book written by partson nyatanga (a cis member) in its third edition the book is meant to assist students pursue their studies of zimbabwe tax law from diploma level to masters level the book covers the curriculum of professional bodies in zimbabwe like icsaz, acca, saaa, ibas, and iacA GUIDE TO ZIMBABWE TAXATION: TAXATION STUDY TEXT APPLIED TAXATION – Module 1 TAX 402 ii FOR 2018 CTA 2 EXAMS Property of CAA Learning Media CAA CAA Learning Media is an ICAZ Approved Learning Partner This means we work closely with ICAZ to ensure this Study Text contains the informationICAZ 2018 CLASS APPLIED TAXATION MODULE 1 2018Home / File / An Outline Of The Mining Taxation Regime In Zimbabwe An Outline Of The Mining Taxation Regime In Zimbabwe Related Articles “In Our Own Words” Young People Growth:The internship concept Next Mining Within Zimbabwe’s Great Dyke: Check AlsoAn Outline Of The Mining Taxation Regime In Zimbabwe

Zimbabewe 2019 midterm fiscal policy review

employment tax rates Deductibility of mining royalties effective 01/01/20 Amendments of specified amounts invarious tax provisions Changes to rate of Capital Gains Tax and Capital Gains Withholding Tax A supplementary budget was presented, which proposed to increase government spending by 140%, from ZW$77 billion to ZW$186 billionRead more about Mining Taxation In Zimbabwe Procedures Introduction 11 Any foreign national/company willing to invest into mining should adhere to the local indigenization law which stipulates a 51% local ownership and 49% foreign ownership in a newly registered company Ministry of Mines and Mining DevelopmentMining Taxation In Zimbabwe Ministry of Mines and Mining Mineral RoyaltiesCorporate Income TaxAdditional Profit TaxWithholding TaxDeductible Expenditure A royalty is a usage based tax which is calculated as a percentage of the gross fair market value of minerals produced and not quantity Royalties are levied in terms of section 244 of the Mines and Minerals Act[Chapter21:05], whilst the Mining Royalties In ZimbabweZimbabwe government mulls new mining taxation by The Insider 5 years ago 5 years ago 0 The government has approved the drafting of a new tax regime in mining sector it hopes will help bring investment into the cashstarved sector and plans to overhaul the country’s income tax laws as well, Finance Minister Patrick Chinamasa said today Zimbabwe government mulls new mining taxation The InsiderIt is proposed to review the corporate income tax rate from 25% to 24% The 3% aids levy still applies Payment of certain taxes in foreign currency It appears the payment of tax in foreign currency now include the payment of Mining Royalties Zimbabwe 2020 National Budget Statement Zimbabwe 2020 National Budget Statement Review Taxation

Losing millions from illicit gold mining trade The

Zimbabwe’s mining sector has a significant role in the development of the country as it brings foreign currency, contributes to government revenue and provides for infrastructure development Since 2009, the mining sector has become the fastest growing with both smallscale mining companies, artisanal miners and multinational companies taking As of 1 January 2020, the corporate income tax (CIT) rate for companies (other than mining companies with special mining leases, but including branches) is reduced to 2472% (previously 2575%) This rate includes a base rate of 24% plus a 3% AIDS levy Zimbabwe presently operates on a sourcebased tax Zimbabwe Corporate Taxes on corporate incomeZimbabwe has thin capitalisation rules based on a 3:1 debttoequity ratio A portion of the overall interest may be disallowed if this ratio is exceeded In addition, any disallowed interest will be treated as a deemed dividend and subjected to a 15% WHT This restriction does not apply to mining companies Tax laws do not allow for losses Zimbabwe Corporate DeductionsJan 05, 2015 this is a book written by partson nyatanga (a cis member) in its third edition the book is meant to assist students pursue their studies of zimbabwe tax law from diploma level to masters level the book covers the curriculum of professional bodies in zimbabwe like icsaz, acca, saaa, ibas, and iacA GUIDE TO ZIMBABWE TAXATION: TAXATION STUDY TEXT Aug 16, 2019 Government’s move to open Zimbabwe for business must not fuel the race to the bottom: The tax regime must be aligned to regional trends to ensure that mining tax How Zimbabwe’s new fiscal regime impacts on mining sector

Presumptive Tax Zimbabwe Revenue Authority

Cross border traders who import commercial goods into Zimbabwe are required to pay a Presumptive Tax equal to 10% of the value for duty purposes (VDP) of the commercial goods The only exception is cases where the trader is registered with ZIMRA for Income Tax purposes and is up to date with submission of tax returns and payment of all taxes dueMining in Zimbabwe, Kadoma Ranch Hotel, Kadoma with indications that over 70 percent of the group are into gold production 1 From the time of the number of taxes paid by the mining industry to various agencies of government Economic Contribution by the ASMs In Artisanal and Small scale Mining in ZimbabweThe complex mining taxation system also presents legal challenges for Zimbabwe Revenue Authority in determining what is due from industry and in instances, when challenged in court over such Mining royalties, taxation rates to be reviewed The Home / File / An Outline Of The Mining Taxation Regime In Zimbabwe An Outline Of The Mining Taxation Regime In Zimbabwe Related Articles “In Our Own Words” Young People Growth:The internship concept Next Mining Within Zimbabwe’s Great Dyke: Check AlsoAn Outline Of The Mining Taxation Regime In Zimbabwe Aug 16, 2019 Government’s move to open Zimbabwe for business must not fuel the race to the bottom: The tax regime must be aligned to regional trends to ensure that mining tax How Zimbabwe’s new fiscal regime impacts on mining sector

Zimbabwe Corporate Taxes on corporate income

As of 1 January 2020, the corporate income tax (CIT) rate for companies (other than mining companies with special mining leases, but including branches) is reduced to 2472% (previously 2575%) This rate includes a base rate of 24% plus a 3% AIDS levy Zimbabwe presently operates on a sourcebased tax The complex mining taxation system also presents legal challenges for Zimbabwe Revenue Authority in determining what is due from industry and in instances, when challenged in court over such Mining royalties, taxation rates to be reviewed The Zimbabwe: Taxation of Mining Operations 11 July 2012 Financial Gazette (Harare) By Garikai Shiri The mining sector has been a major driver of economic and export earnings growth since Zimbabwe: Taxation of Mining Operations allAfricaZIMBABWE Amendments to the Income Tax Act and introduction of new transfer pricing regulations February 2019 The New Minister of Finance issued a number of proposals to the Income Tax Act [Chapter 23:06] most of which take effect from 1 January 2019 Mining allowances for noncontiguous minesZIMBABWE Amendments to the Income Tax Act and INCOME TAX ACT Acts 5/1967, 35/1967, 30/1968, 36/1969 (s 10), 39/1969, 32/1970, 2/1971, 41/1971, 20/1972, 57/1972 (s 34), pits and other prospecting and exploratory works undertaken for the purpose of acquiring rights to mine minerals in Zimbabwe or incurred on a mining location in Zimbabwe, together with any other expenditure (other Income Tax Act [Chapter 23:06] Zimbabwe Legal

Artisanal and Small scale Mining in Zimbabwe

Mining in Zimbabwe, Kadoma Ranch Hotel, Kadoma with indications that over 70 percent of the group are into gold production 1 From the time of the number of taxes paid by the mining industry to various agencies of government Economic Contribution by the ASMs In Academiaedu is a platform for academics to share research papers(PDF) A Guide To Zimbabwe Taxation i Edmore Mabeka Taxation Paper F6 (ZWE) (Zimbabwe) Tuesday 3 June 2014 The Association of Chartered Certified Accountants This is a blank page The question paper begins on page 3 2 SUPPLEMENTARY INSTRUCTIONS 1 Calculations and workings need only be made to the nearest US$1, unless directed otherwise Exemptions from income tax year ended 31 December Taxation (Zimbabwe)Jan 11, 2017 Source: Zim mulls new mining tax – DailyNews Live January 10, 2017 HARARE – Zimbabwe is planning to introduce a new mining tax this year aimed at boosting the country’s depleting revenue streams, businessdaily has established Finance minister Patrick Chinamasa said the country has engaged an unnamed tariff consultancy firm from Norway to come up with the new tax regimeZim mulls new mining tax Zimbabwe Situationmining industry reflect that: “for existing business where government does not have 51%ownership, compliance with the Indigenization and Economic Policy should be through ensuring that the local content retained in Zimbabwe by such business is not less than 75% of gross value of the exploited resourcesUPDATE ON THE ZIMBABWE MINING POLICIES AND

Mining firms fingered in tax evasion The Chronicle

THE country could be losing millions in potential revenue through tax evasion among other underhand dealings involving players in the mining sector, according to the Zimbabwe Revenue Authority May 30, 2017 ZIMBABWE needs to design a proper mining taxation regime to establish an appropriate royalty system that ensures the economy realises optimal revenues during a commodity boom and bust period, a Govt loses out on mining tax – NewsDay Zimbabwe